What Does the Omnicom IPG Acquisition Mean for Advertising?

While it may seem colossal, the forces it will accelerate have been speeding up regardless of blockbuster deals like this.

Last week Omnicom announced that they are buying Interpublic Group in an all-stock deal worth around $13 billion. This would create the largest holding company in the world of advertising, which has many people wringing their hands and clutching their pearls. What will this mean for the worker bees driving the product for the clients being wooed by holdco executives on yachts at Cannes?

The reality is, not much. The holding company model has been evolving into its final stage of late: “bespoke” agencies for major clients willing to consolidate business into a single holdco. All of them do it under different names, but the end result could well be the same if nothing changes: a single, monolithic holding company with bespoke client teams devoid of individual agencies underneath them. That’s the real threat.

Omnicom Merger, Take Two

When this newsletter’s author was a wee lad a decade ago, Omnicom tried something similar with Publicis but it fell apart spectacularly - even after both sides sunk eight figures into the potential deal. Don’t expect the same to happen this time around.

Back in 2014 the potential Omnicom-Publicis merger very publicly collapsed, with Omnicom’s John Wren blaming regulatory issues but Publicis’s Maurice Levy being a bit more candid, pointing the finger at Wren and team as widely deviating from the “merger of equals” both sides were trying to portray.

Indeed, Wren wanted the most crucial c-suite roles filled by Omnicom people, in a move that didn’t pretend to nod to a notion of equality between the two advertising leviathans. Ego most certainly got in the way of this deal and comparing their salaries that year, I’m not sure the French are to blame on this one.

So Is This One Going to Fall Apart, Too?

Even though John Wren is at the center of this deal, the potential for corporate catastrophe is much, much lower for a few reasons.

One, the sheer size of the deal is a fraction of what it was back in 2014 ($35 billion [really almost $50 billion in 2024 dollars] in the “merger of equals” vs. $13 billion for a clearly defined takeover.) Smaller size makes it less complex.

Second, it’s not a merger. Omnicom is straight up buying IPG and they’re doing it with the value of their stock - no cash will be changing hands. There is no pretending to be equals or no egos to be bruised - a much simpler transaction from a PR perspective.

Third (and this is a minor consideration, but still one that needs to be talked about) there is a snowball’s chance in hell that the Trump administration will do anything remotely resembling being a roadblock to business. You’d be hard-pressed to prove a case on consumer harm given these holdcos are B2B service businesses, but even under an evolving antitrust attitude in DC there likely isn’t the political will for it.

So What Does This Mean for Advertising?

Honestly, probably not much. The holding company model is not new and - led by Publicis’s insane post-Covid growth - has become more central to major advertising today. The economies of scale brought on by consolidation have been achieved - the only other way to squeeze more water out of that stone is to supercharge M&A like Omnicom is doing with IPG.

But the efficiencies will be marginal - right now $750 million over two years is being quoted, with most of that coming from real estate savings (ha!), tech efficiencies and shared services. For a combined entity that will have net revenue of $20 billion a year, this is not huge.

The trends around consolidation (race to the bottom on fees, increased financial pressure from holdcos through to individual agencies, debt loads to further M&A in the data space) will continue - the only change may be the pace at which those trends move forward. There’ll be a slight increase, but nothing cataclysmic.

An Ode to the Individual Agency

One trend under the holdco model that has accelerated of late is the bespoke agency under a holding company for a large-enough client. This is something that has accelerated since Covid and does not seem to have signs of slowing down.

We’ve spoken before about AORs and bagging big clients in the agency space. In order to service a large client, you typically need a big team. Big teams tend to come from big agencies, but when you have a big enough client - with things like omnichannel media buys and global scale - a single agency may come up short from a staffing and/or capabilities perspective.

The holding company has a solution to that: they pull talent from other agencies based on specialty and create a multi-agency team for a client. If the client is a whale, they may very well set up an entirely separate legal agency to service the client. Omnicom tends to call it group-level servicing while Publicis has branded this “Power of One.”

Whatever one calls it, the benefits are obvious - being able to draw on the talent of an entire holdco versus a single agency has its benefits. Of course, there are drawbacks as it can introduce further bureaucracy into the model (that dreaded “overhead” on a P&L), but since its introduction in the mid-aughts, large clients seem to like the arrangement.

One of the major drawbacks has nothing to do with clients: agency culture. One of the things that make agencies special is their unique culture and working environment. If you began in the industry before Covid, this was a lot more prevalent and obvious. If you’re a post-Covid entrant to the advertising world, you would be forgiven for wondering what the difference is between agencies outside of their c-suites.

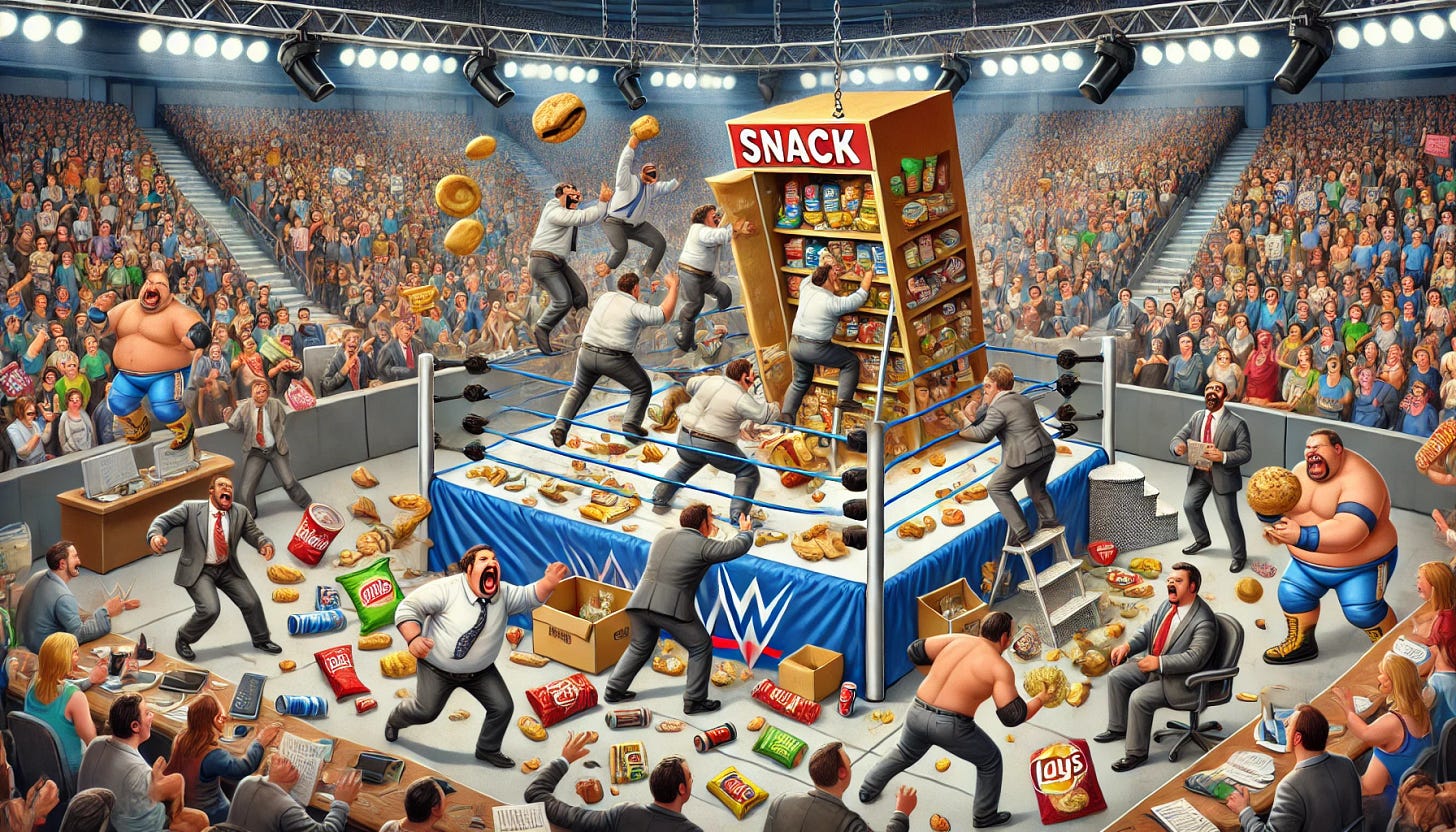

The very things that drive advantages for holding companies actually degrade individual agency culture. Splitting capabilities among agencies for a single client firewalls multiple corporate cultures in a single scope. Real estate consolidation and open office plans are poison to a healthy culture (and lead to mind numbing fights over snack closets.) Tighter financial budgets for non-billable items like happy hours or team dinners to make holdco margin targets further erode agency team building.

Looking back at an admittedly short agency career at multiple holding companies, this is where I see the the biggest dropoff. Agencies always had numbers to hit; they were always at risk of layoffs due to a client leaving; they always had to divide and conquer in areas to get good product out the door. But it used to be, dare I say, kind of fun to work at some agencies (not all of them, certainly, but there were some special ones out there and this author has been lucky enough to work at them.)

What the holding companies did was take these negative aspects of agency life to such an extreme that what was supposed to drive better efficiency for agencies actually ended up a race to the bottom in the name of shareholder value, and it took a lot of agency culture with it. We’re not even going to get into the mechanics of the verticalization model within holding companies because it is so mind-numbingly inside baseball.

To be clear, the agency isn’t dead by any means - I was recently talking with a colleague and we were lamenting about how much we liked where we were because it removed a lot of leverage in any future negotiations on salary and promotion because that intangible culture and community that we had been a part of for so long was still a strong pull to stay. But I’ll be honest, dear reader, I see that as the exception to the rule and I also see holdco policies already encroaching on individual agency identity.

The ills facing agencies today tend to fall into the bucket of what many other corporations are dealing with in late-stage capitalism - doing more with less, change at a pace previously unimaginable, political and social upheaval we haven’t really seen since Nixon, and a myopic focus on quarterly shareholder value at the expense of almost everything else. One aspect where agencies can set themselves apart is culture, but the holdcos need to recognize that and play ball. There’s still time, but the clock is ticking faster than it ever has.