It's Not the Destination, It's the Journey

Being in the office is one thing. Getting there is a whole other ballgame.

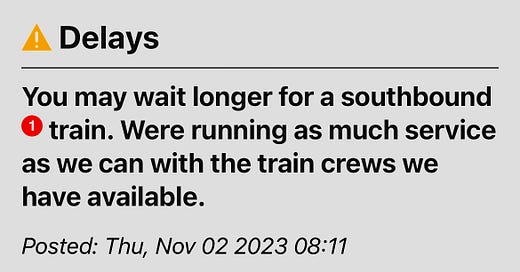

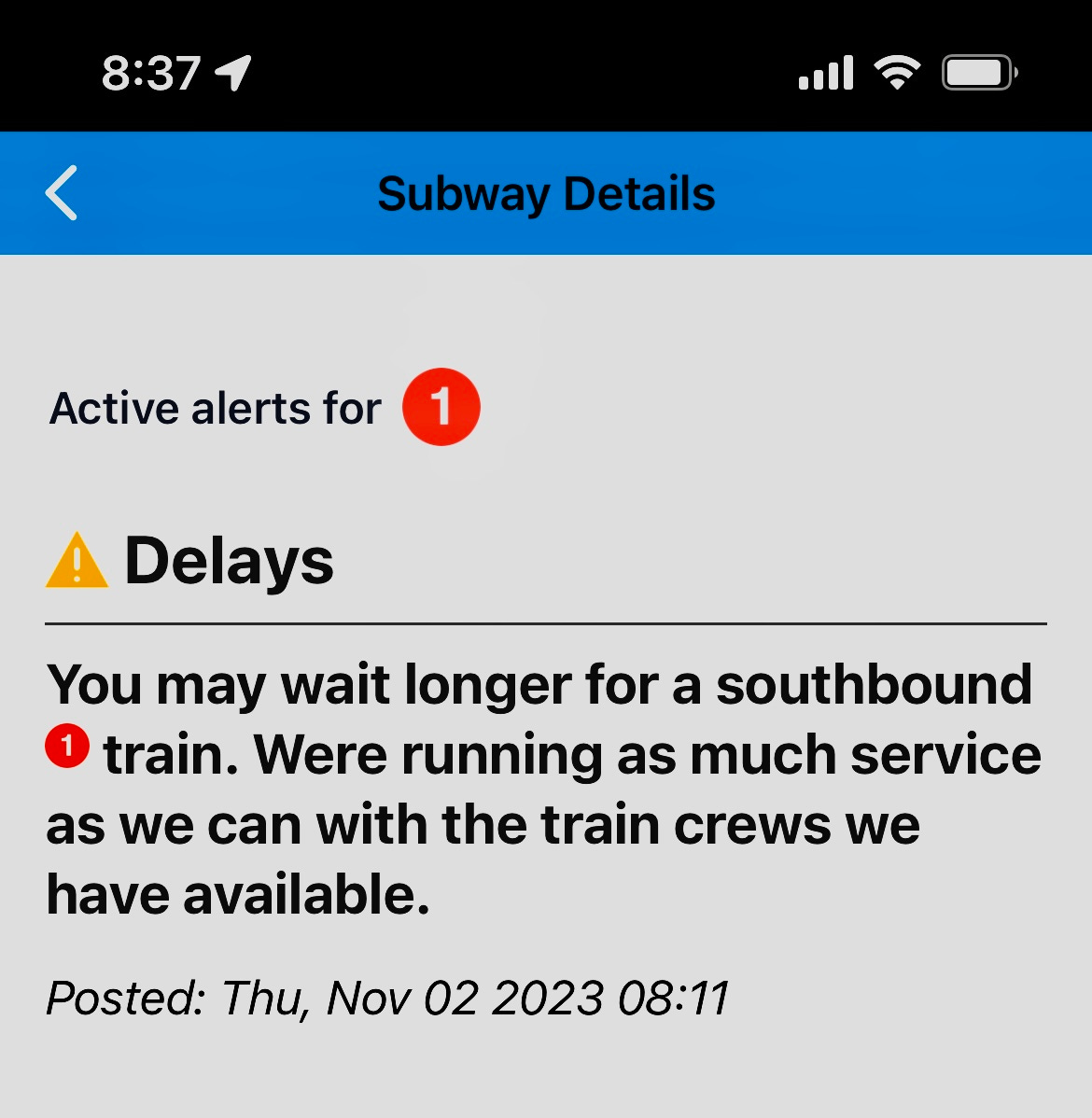

I was having a frustrating commute the other day when I noticed that the Broadway trains were a bit further spaced than they should have been for rush hour and were getting a little more crowded than usual. I opened the handy MYmta app to see what was going on. As suspected, the 1 train was delayed. But the reason is what popped out at me:

Usually, I’d just point to the chronic underfunding of the MTA as the reason they continue to suck, but that excuse isn’t valid anymore. For the first time since I moved to New York as a bright-eyed bushy-tailed college freshman in 2004, the MTA is fully funded. Let me repeat that: the MTA is fully funded and has balanced its budget for the next five years but is still having these issues. So how are we supposed to RTO?

Transit Death Spiral Avoided

In the midst of the pandemic, the topic of transit death spirals and urban doom loops became more practical than theoretical.

A transit death spiral begins when ridership falls due to some type of macro circumstance (most recently Covid 19, but other black swan events like 9/11 and the global financial crisis caused similar hand-wringing.) With reduced ridership, the transit system begins losing revenue and becomes underfunded (or, in the case of most urban transit systems, becomes more underfunded than usual), which leads to service cuts and drops in reliability, which leads to less ridership, thus catalyzing the entire process all over again until it becomes unsustainable.

Luckily for New York, that fate was avoided and one of the reasons for that was mandated RTO. Municipalities essentially begged large companies (Eric Adams proposed collusion among companies) to come back to the office for many reasons, but the two main ones were to revive their downtowns and provide a revenue boost to their transit systems.

But I Thought RTO Was About Collaboration

It is, but it’s a bit lower on the list under the fiscal priorities. Real estate is a fixed cost and CFOs will be damned if you’re not coming in and using that asset while they’re locked into their lease. Also for client service businesses, their customers don’t want to pay for it as part of overhead if they’re seeing analysts’s apartment backgrounds on Zoom calls. They want to see open office plans on Zoom call backgrounds instead.

Quick aside: there are actual benefits to employees with RTO. In-person collaboration is beneficial (when everyone is in person.) Coming into the office to sit on video calls is not any more productive than it is at home (less so when you factor in commutes), but if a full team is there it does makes sense. Does it need to be done five days a week? Absolutely not, but to say there are zero benefits to RTO done well is disingenuous and a self-defeating argument when discussing RTO.

C.R.E.A.M. in Your Morning Coffee?

Which brings us to our theme (another financial one): RTO is supposed to help downtowns avoid a doom loop.

Similar to the transit death spiral, the doom loop occurs when municipal taxes fall off due to a combination of decreased sales tax receipts of office workers paying $20 for lunch salads and commercial real estate market value plummeting, leading to decreased property taxes. With less money, cities have to cut budgets for critical services, making them less desirable places to live and work, further depressing property values.

Because the precarious position that commercial real estate finds itself in (propped up by insane debt loads), tax receipts aren’t the only thing at stake if CRE becomes too depressed. Systemic defaults on commercial properties would ruin the economy: I think we all remember what happened last time a property-based asset class considered bulletproof was exposed as less-than-stellar.

To put a finer (yet blunter) point on it, employees are being used as pawns in an RTO game that requires them to come into the office so major commercial real estate firms maintain the market value of their portfolios.

Of course, if the carrot doesn’t work, there’s always the stick of taking away the tax breaks that companies got for locating themselves in certain cities. Another reason state and city tax breaks for major corporations are self-defeating, but I digress.

This puts lot on the employee: you need to help turn things around with your company by coming back into the office, while also saving an arguably overleveraged commercial real estate industry while simultaneously helping to save the banks that underwrote all of that debt so they don’t fail as the Fed keeps hiking interest rates and JPow won’t say uncle.

To top it all off, it might not even be enough as mezzanine loans (a shady CRE practice of taking on debt at insane interest rate levels outside of the traditional mortgage system) are seeing a disturbing hike in foreclosure activity.

But Good Luck Getting There

Which begs the question: Why are the municipalities who begged us back into the office making it harder than it needs to be? Here in New York, the MTA raised fares (again) just as RTO was getting into full swing for many tri-staters.

And now the MTA is straight up saying “Hey, we’re running as much as we can but we know it’s not enough. Thanks for choosing to ride with us.” As if anyone chooses an organization as rife with dysfunction as the MTA - even Andy Byford told us to fuck ourselves, and the Brits tend to be a bit more polite.

If it’s going to be up to employees to pay extra for our commutes to come into the city centers we moved away from during Covid, pay inflated prices for lunch from companies whose main revenue is VC funding, and help maintain commercial real estate values so Tishman Speyer doesn’t become WeWork, is it too much to ask that it at least not be a Homeric odyssey to actually get that Kastle swipe recorded and make it into the office?

Grab Bag Sections

WTF MTA: This whole post is a WTF MTA section, so let’s use album of the week to take a deep dive detour into the Midwest rap scene in the early aughts.

Album of the Week: Fall of junior year of high school Murphy Lee dropped Murphys Law. It was the second album in three weeks that dropped from a lesser-known member of a wildly popular rapper’s clique (Obie Trice from Eminem’s D12 released Cheers the previous month.) I was already a Nelly fan, so was Murph Dirt going to lift up all of the St. Lunatics into stardom?

In short, the album is very good. It has no business being as solid as it is coming from a number two in a collective that is (and I say this out of love) simply terrible. It follows a calculated move by the St. Lunatics - a popular group in the Missouri area in the late 90s - to have Nelly go solo with a record deal and then hopefully draft behind that. And it looked like it was going to work.

The album went gold (an accomplishment in the CD era), cracked the top 10 on the Billboard 200, and spawned a Grammy-winning, international hit single that topped Billboard charts featuring Nelly and Diddy. That should set someone up to avoid the sophomore slump.

But then…nothing. I didn’t expect much from the rest of the St. Lunatics, but I expected Murphy Lee to have a somewhat longer career. But between getting caught up in fame (he was only 24 when the album came out) and a label transition around the time he’d be asking for budget for a second album, Murph stayed on the shelf. A tale as old as time in the music industry.

Quote of the Week: “Leadership is getting players to believe in you. If you tell a teammate, you’re ready to play as tough as you’re able to, you’d better go out there and do it. Players will see right through a phony. And they can tell when you’re not giving it all you’ve got.” - Larry Bird

See you next week!